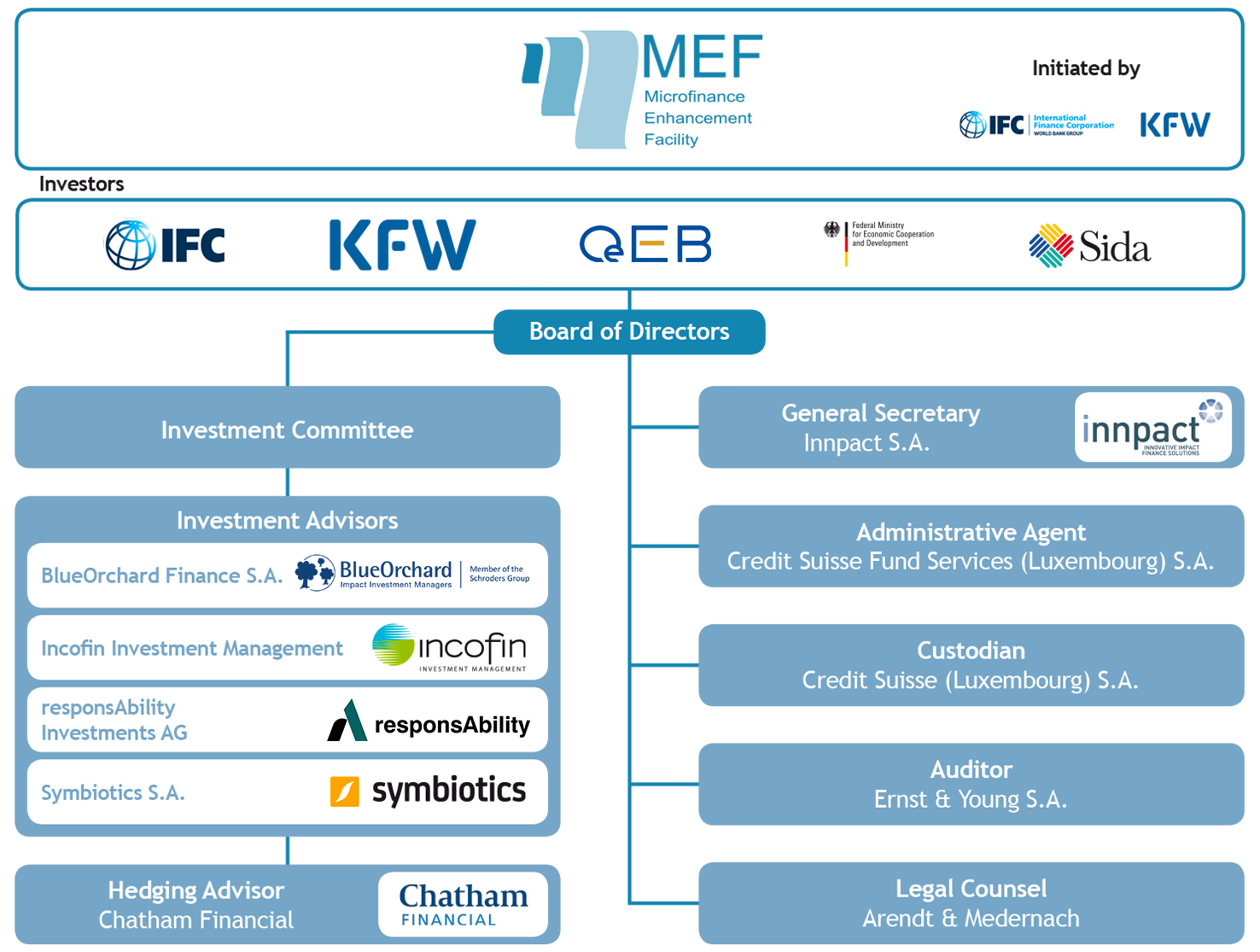

Organisational structure

Microfinance Enhancement Facility SA, SICAV-SIF, is a société anonyme, qualifying as a société d’investissement

à capital variable-fonds d’investissement spécialisé (SICAV-FIS)

under the Grand Duchy of Luxemburg specialised investment funds law of 13 February 2007.

Board of Directors

The Board has prime responsibility for all aspects of the administration and management of the business of the Fund. MEF’s Board of Directors assembles a team of experienced professionals with financial markets and microfinance industry experience, as well as direct experience in key markets around the globe.

Specific responsibilities of the Board of Directors include:

- Administering and managing the Fund

- All investments activities of the Fund

- Ensuring that donor funding is honoured and that cash and other investments are managed wisely, and

- Ensuring the Fund’s compliance with laws and regulations

- The Board is currently composed of six members elected by the shareholders.

Investment committee

The investment committee’s purpose is to assist the Board in its oversight of all of the following:

- Coordinate and oversee the Fund’s investment portfolio

-

Supervise the management of the Investment Advisors within the guidelines of the Fund,

including the investment policy, and, in particular, monitor:

- the pipeline of investments

- the portfolio transactions and disinvestments and

- the financial structure and performance of the portfolio and investments

The Investment Committee will furthermore make decisions on investments in MFIs, as well as in other areas from time to time indicated by the Board. The Board of Directors has appointed an investment committee, of which each member has an alternate who will replace the investment committee member in case of absence.

Investment advisors

For the purpose of efficient management, the Fund has opted to have its microfinance assets managed by specific Investment Advisors under the supervision of the Investment Committee. Investment Advisors make investments on behalf of the Fund on the basis of approvals from the Investment Committee or the Board as the case may be. For more information please refer to section Investment process

General Secretary

The Fund has appointed Innpact S.A. (“Innpact”) as General Secretary to provide certain

coordination services for the management of the Fund as well as certain other tasks.

Innpact is particularly charged with the general coordination of the relationship

between the Investment Advisors and the Investment Committee, ensuring a

timely process for the assessment by the Investment Committee of the investment

proposals prepared by the various Investment Advisors. Innpact also ensures that

the Fund’s policies and procedures are kept up-to-date and are adhered to by the Investment Advisors.

Custodian Bank and Administrative Agent

The Custodian Bank is responsible for the safekeeping of the assets of the Fund. The Administrative Agent shall perform all administrative duties that arise in connection with the administration of the Fund, including the entering into Loan Agreements, the issue and redemption of Shares and Notes, calculation of the Shares’ Net Asset Value, accounting and maintenance of the register of Shareholders, of Noteholders and of Lenders.

Hedging Advisor

Chatham Financial provides risk management advisory services to hard currency denominated investors

who seek to make local currency investments in emerging and frontier markets.

Chatham’s history of involvement in the microfinance sector dates to the early 2000s,

leading to the formation of Cygma, a Chatham subsidiary exclusively focused on the microfinance sector.

In early 2012, Cygma re-combined its operations with Chatham to form our current Emerging and Frontier Markets Team,

which continues to provide customized currency risk analysis and hedge advisory to investors in microfinance

and adjacent sectors focused on impact investing. The team has experience in executing hedge transactions in

more than 30 currencies globally.